National Savings Revises Profit Rates for Certificates

The adjustments in profit rates and investment inflows reflect the CDNS's efforts to adapt to changing economic conditions and provide competitive returns to investors, while also promoting a culture of savings in the country.

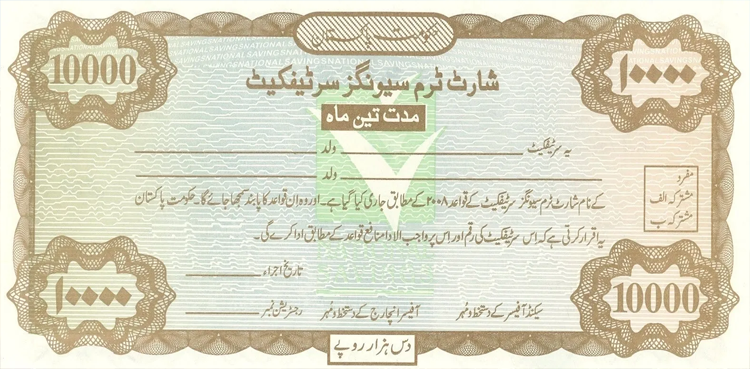

The Central Directorate of National Savings (CDNS) has adjusted the profit rates for Short Term Savings Certificates (STSCs), effective February 2025, in response to the country's declining inflation rate. The new profit rates are 11.24% for 3-month maturity, 11.32% for 6-month maturity, and 11.38% for 1-year maturity.

The revised rates will yield returns of Rs2,810, Rs5,660, and Rs11,380 on a Rs100,000 investment for the respective maturity periods. Taxation on profits will depend on the investor's tax status, with a 15% withholding tax for those on the Active Taxpayer List and 30% for non-filers. The State Bank of Pakistan (SBP) has reported a significant increase in net inflow of Rs20.78 billion in National Savings Schemes (NSS) in December, compared to Rs14.5 billion in the previous month.

The different categories within NSS have shown varying trends, with the Defence Saving Certificates (DSC) experiencing a net outflow of Rs1.55 billion, while Regular Income Certificates (RIC) and Special Savings Certificates (SSC) recorded inflows of Rs5.64 billion and Rs2.62 billion, respectively. Prize Bonds also saw an injection of Rs1.75 billion, and other savings categories within NSS received receipts totaling Rs12.32 billion, a substantial increase from the previous month.

In another development, the CDNS has reduced the profit rate on Regular Income Certificates (RICs) to 11.74% from 11.88%, effective February 14, 2025. The certificates offer a five-year maturity period, with monthly profit payments, and can be purchased by Pakistani nationals and overseas Pakistanis without any maximum investment limit. The profit is tax-deductible at 15% for those on the Active Taxpayer List and 35% for non-filers.

The revised profit rates and increased investment in National Savings Schemes indicate a positive trend in the country's savings landscape, with the CDNS aiming to encourage more investments and provide attractive returns to investors.