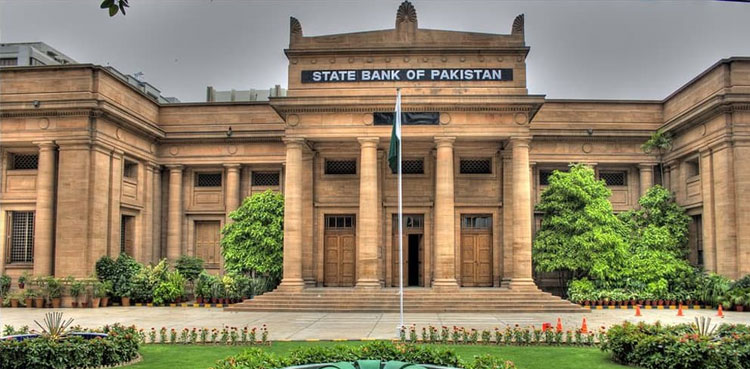

State Bank of Pakistan Monetary Policy Unveiled Today

The SBP's decision is expected to have a significant impact on the economy, with implications for businesses and individuals alike. As the economy continues to navigate the challenges of inflation and external pressures, the SBP's monetary policy will remain a key factor in shaping the country's economic trajectory.

The State Bank of Pakistan (SBP) has decided to keep the policy rate unchanged at 12% after assessing the current real interest rate to be adequately positive on a forward-looking basis to sustain macroeconomic stability, despite expectations of a 50-100 basis points cut in interest rate.

The Monetary Policy Committee (MPC) noted that inflation in February was lower than expected, mainly due to a drop in food and energy prices, standing at 1.52%. However, the committee also expressed concerns about the risks posed by the volatility in these prices, which could lead to an uptick in inflation. The current account remains in surplus at $0.7 billion in the last seven months, compared to a $1.8 billion deficit in the same period last year.

The central bank's foreign exchange reserves stand at $15.8738 billion, with $11.4295 billion in the central bank. The MPC expects the current account to turn into a deficit in the second half of the fiscal year 2025, but reaffirmed its projection of a surplus and a deficit of 0.5% of GDP for the year. The committee emphasized the importance of maintaining a cautious monetary policy stance to stabilize inflation within the target range of 5-7%.

The decision by the SBP to keep the policy rate unchanged is seen as a move to balance the need to support economic growth with the need to control inflation. The MPC reiterated the need for fiscal reforms to support macroeconomic stability, highlighting the importance of a coordinated approach to achieving economic stability.