Industrialists Press for 5% Cut in Pakistan's Policy Rate

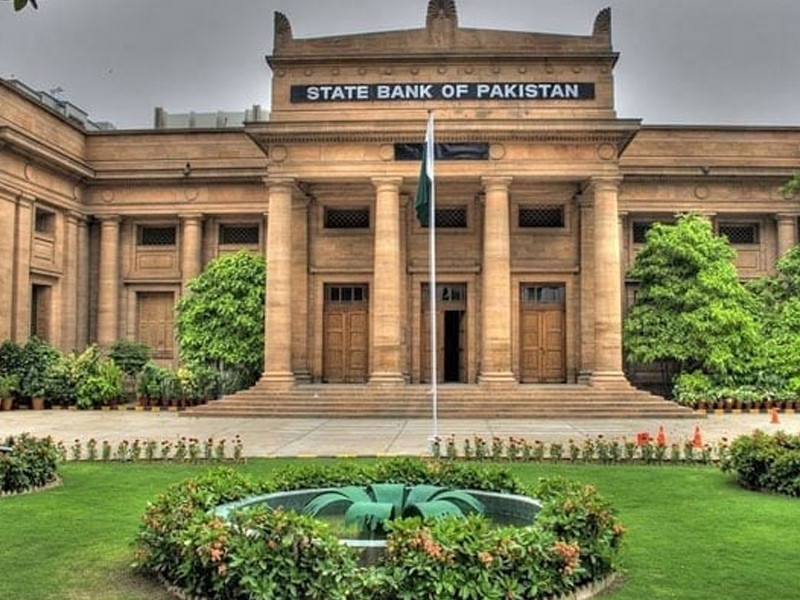

Pakistan's industrialists have stepped up pressure on the State Bank of Pakistan (SBP) to slash the policy rate by 5% to boost economic activity and address the crippling high interest rates. Industry leaders claim that the current high interest rates are stifling growth, restricting access to credit, and placing the country at a competitive disadvantage.

The call for a rate cut comes as the domestic debt servicing has surged by 50.4% to Rs7.2 trillion in FY24, largely due to high interest rates, which have further worsened fiscal pressure and widened budget imbalances. Industry leaders, including Muhammad Kamran Arbi, Farooq Shaikhani, Siraj Sadiq Monnoo, and Farazur Rehman, have urged the SBP to address these concerns in the upcoming Monetary Policy Committee (MPC) meeting. They argue that maintaining high interest rates will not only hurt economic growth but also limit private sector credit growth. This viewpoint is supported by the recent decline in inflation, which has left the real interest rate at a highly positive 10pc.

While the SBP is expected to maintain a cautious stance, financial experts and the trade and industry sectors have differing expectations for the rate cut, ranging from 400 to 500 basis points to a more conservative cut of 200 to 300 basis points. Analysts predict that inflation will continue to decline, thus creating room for further interest rate cuts. However, the SBP may adopt a gradual approach in lowering the policy rate to single digits, as opposed to the industry's demand for a 5% cut in one go.

The demand for a policy rate cut by industrialists highlights the pressing need to balance economic growth with fiscal prudence. As Pakistan seeks to revive its economic activity, the SBP will need to carefully consider the trade-offs between borrowing costs and growth prospects. A careful calibrated rate cut can help mitigate the effects of high interest rates and revive economic activity, but it is key that any decision taken by the SBP is guided by careful analysis of economic indicators and careful consideration of the potential risks and consequences.