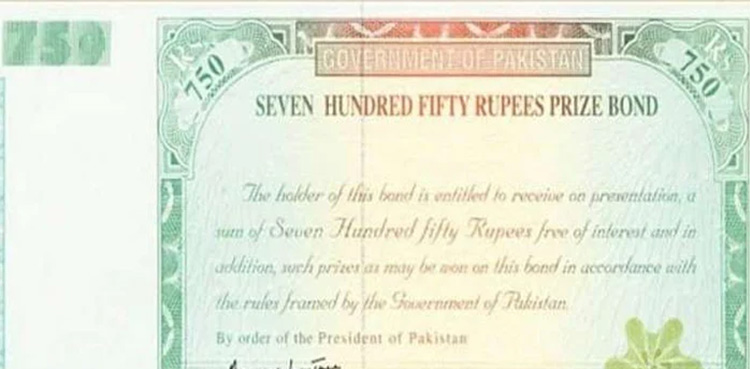

New Prize Bond Schedule Revealed for 2025

The National Savings Division has unveiled its calendar for the 2025 Prize Bond draws, outlining key dates for the Rs750 bond draws and a reminder for the Rs200 bond draw. In a recent announcement, the division detailed the schedule for the 2025 draws, scheduled to take place in various cities across Pakistan.

According to the released schedule, the first draw for the Rs750 bond is set to take place on January 15, 2025, in Karachi, marking the beginning of the 2025 draw series. This will be followed by additional draws in April, July, and October, which will be held in Peshawar, Rawalpindi, and Muzaffarabad. Winners of the Prize Bond draws can claim their prizes from designated branches, a service facilitated by the National Savings Division for the convenience of the public. Each draw is expected to fill the public with excitement and anticipation as individuals eagerly await the chance to win stunning prizes.

Meanwhile, a reference to a recent draw, the Rs200 Prize Bond was conducted on December 16, 2024. A lucky winner walked away with a substantial prize of Rs750,000, drawing the attention of many potential Prize Bond investors.

In other news, the State Bank of Pakistan (SBP) has circulated a reminder to the public to tenders their National Prize Bonds (NPBs) of denominations Rs40,000, Rs25,000, Rs15,000, and Rs7,500. These bonds need to be encashed, replaced, or converted before December 31, 2024. Initially set for June 30, 2024, the deadline has been extended, and commercial banks have been informed that they should accept requests for encashment, or conversion or redemption of these Bonds until December 31, 2024.

Banks are required to submit branch and region-wise consolidated data of NPBs held by them by January 2, 2025 and surrender the bonds to the respective SBP BSC office by January 31, 2025. This process will enable the banks to remove all inactive National Prize Bond (NPB) prizes from their database and ensure compliance with official directives.

The National Savings Division has underscored the importance of being compliant with these deadlines. By operating within the stipulated timeframe, all parties involved, including commercial banks and the National Savings Division, can efficiently proceed with the encashment and redemption of bonds. It is essential that the bondholders collaborate with commercial banks that offer the services of manager funds, providers of essential papers about accounts, thereby avoiding any confusion in deadline timing and methods.